Easystake

Staking as a Service

Staking-as-a-Service allows TosDis to offer staking to all ERC20 and BSC projects, making it easy, accessible, and affordable to all current and upcoming projects. Ultimately, it’s our goal to integrate as many chains as possible to our platform.

Easystake

Yield Farming as a service

Yield farming-as-a-service takes our staking solution one step further by offering yield farming and liquidity mining to all ERC20 and BSC projects. By doing so, we aim to make these advanced technologies accessible to all current and upcoming projects at a reasonable price, while also removing the barrier of development time and costs. Again, our goal is to integrate as many chains as possible to our platform.

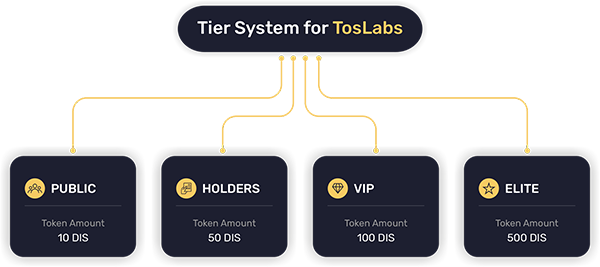

TosLabs will serve as an incubator for new and upcoming innovative projects, which will be properly vetted in order to guarantee the smoothest experience for sale participants as well as project owners. By assisting these projects with our connections and expertise, Toslabs is more than just a platform to raise capital. TosLabs will support the ERC20 and BSC network, but more chains will be integrated.

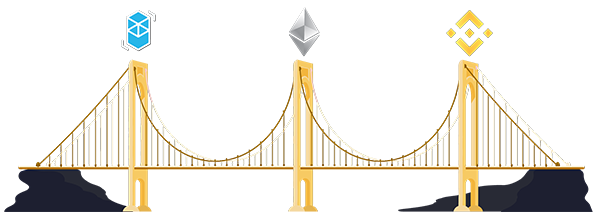

DIS Bridge

Our bridge & Cross-chain compatibility

A fast and secure bridge that allows migration of any ERC-20 token to the Binance Smart Chain and vice versa with a vision of interoperability and cross-chain opportunities to other ecosystems.

Easystake

Liquid Staking

Liquid staking allows staked assets to become liquid. When users stake stake their assets through TosDis EasyStake, they will receive a 1:1 asset-backed token for the staked asset, which can be traded, transferred, or used as collateral in the world of DeFi or on any supported network.

Tokenomics

- Ticker: DIS

- Initial Supply: 100,000 DIS

Roadmap